Introduction

In the world of cryptocurrencies, security is paramount. Cold storage hardware is an essential component of a secure crypto strategy. By keeping your digital assets offline, you can protect them from online threats like hacking and phishing. In this article, we will explore the concept of cold storage hardware, the different options available, and how to set up and use these devices securely.

1. Understanding Cold Storage

- Definition: Cold storage refers to the practice of keeping cryptocurrency private keys and access credentials offline, away from internet-connected devices. This isolation makes it nearly impervious to online hacking attempts.

- Primary Purpose: Cold storage is primarily used for long-term storage of cryptocurrencies to safeguard them from cyberattacks.

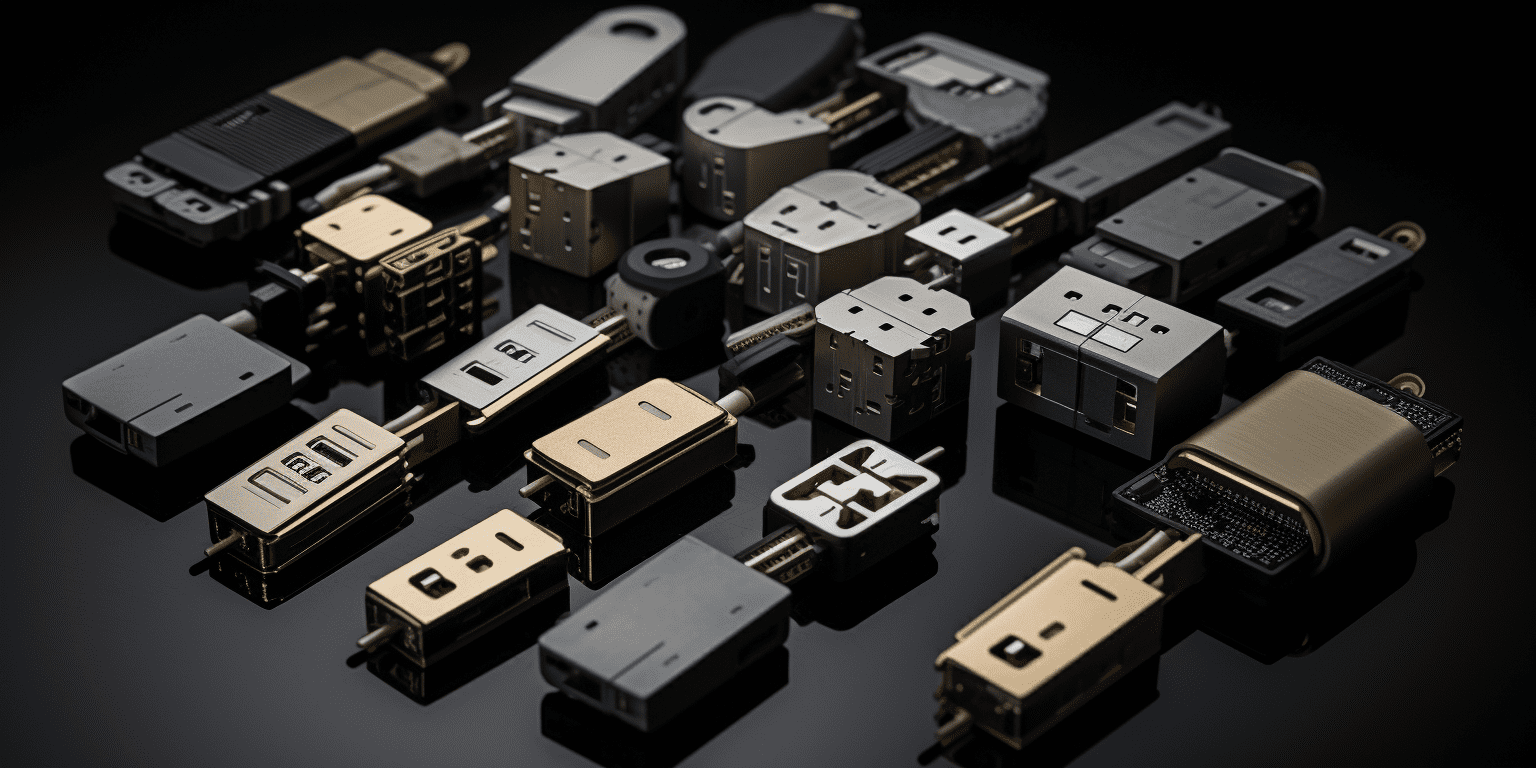

2. Types of Cold Storage Hardware

- Hardware Wallets: Hardware wallets are physical devices that store your cryptocurrency private keys offline. Examples include Ledger Nano S, Ledger Nano X, Trezor, and KeepKey.

- Paper Wallets: A paper wallet is a physical document that contains your cryptocurrency public and private keys. It’s generated offline for maximum security.

- Air-Gapped Computers: These are standalone computers that are never connected to the internet, ensuring that your keys are never exposed to online threats.

- Metal Wallets: Metal wallets are physical plates or cards where you engrave or etch your private keys. They are resistant to physical damage and corrosion.

3. Setting Up a Hardware Wallet

- Purchase: Acquire a hardware wallet from a reputable source. Be cautious of buying from third-party sellers to avoid tampered devices.

- Initialization: Follow the device’s setup instructions carefully. This usually involves creating a PIN, writing down a recovery seed phrase, and verifying it.

- Recovery Seed: The recovery seed is a crucial backup. Write it down on paper, and store it in a safe and secure location, preferably in multiple copies.

- Transfer Funds: Transfer your cryptocurrencies to the addresses generated by the hardware wallet.

- Offline Transactions: Hardware wallets allow you to sign transactions offline, ensuring your private keys remain secure.

4. Benefits of Cold Storage Hardware

- Security: Cold storage hardware is highly secure, as it keeps private keys offline and away from potential online threats.

- Long-Term Storage: It’s ideal for storing cryptocurrencies you don’t plan to use frequently, such as long-term investments.

- Protection from Phishing: Hardware wallets are immune to phishing attacks since they do not expose private keys.

5. Risks and Considerations

- Loss or Damage: Physical hardware wallets can be lost, damaged, or stolen. It’s essential to have a backup recovery seed.

- Initial Investment: Hardware wallets come with an upfront cost, unlike software wallets that are often free.

- Counterfeit Devices: Be cautious of counterfeit hardware wallets. Purchase from reputable sources to ensure authenticity.

6. Regular Updates and Maintenance

- Firmware Updates: Keep your hardware wallet’s firmware updated to patch security vulnerabilities.

- Backup Seed: Regularly check the backup seed and ensure it’s securely stored.

7. Conclusion

Cold storage hardware is a fundamental tool for anyone serious about cryptocurrency security. By keeping your private keys offline, you significantly reduce the risk of online threats and hacking attempts. Whether you choose a hardware wallet, paper wallet, or air-gapped computer, the key to success lies in careful setup and secure management. Safeguarding your cryptocurrency investments should be a top priority in your crypto journey, and cold storage hardware is an indispensable part of that effort.

Disclaimer: This article is for informational purposes only and should not be considered as financial or investment advice. Users should conduct their research and exercise caution when managing their cryptocurrency holdings.