In the era of digital currencies, mobile wallets have gained popularity as a convenient way to manage cryptocurrencies on the go. These applications allow users to store, send, and receive their digital assets securely right from their smartphones. However, with great convenience comes certain risks. This comprehensive guide explores the advantages and risks of using mobile wallets for managing crypto, empowering users to make informed decisions while safeguarding their digital assets.

I. Understanding Mobile Wallets:

Mobile wallets are software applications that allow users to store, manage, and transact with digital currencies from their mobile devices. This section provides an overview of mobile wallets, the various types available, and how they work to facilitate secure crypto transactions.

II. The Benefits of Mobile Wallets:

a. Convenience and Accessibility: Discover how mobile wallets provide users with instant access to their digital assets, eliminating the need for carrying physical wallets or accessing a desktop computer for crypto transactions.

b. Instant Transactions Anytime, Anywhere: Explore the ability to send and receive cryptocurrencies quickly and conveniently at any time, regardless of location.

c. Enhanced Security Measures: Learn how top mobile wallet providers implement robust security measures, including encryption and biometrics, to safeguard users’ digital assets.

d. Easy Portfolio Management: Understand how mobile wallets offer features such as real-time portfolio tracking, transaction history, and price alerts to efficiently manage crypto holdings.

III. Risks and Challenges of Mobile Wallets:

a. Vulnerabilities and Potential Security Breaches: Explore common vulnerabilities faced by mobile wallets, such as malware, phishing attacks, and insecure networks, emphasizing the importance of choosing reputable wallet providers and implementing security best practices.

b. Loss, Theft, and Damage of Mobile Devices: Discuss the risks associated with losing or having mobile devices stolen, highlighting the importance of backup and recovery options.

c. Phishing, Malware, and Fake Wallets: Educate users about potential threats, such as phishing scams, malware-infected apps, and fake wallets, and provide tips to identify and avoid such risks.

IV. Best Practices for Secure Mobile Wallet Usage:

a. Choosing a Reputable and Trusted Mobile Wallet Provider: Guide users in selecting trustworthy wallet providers with a strong track record and positive reviews.

b. Implementing Strong Security Measures: Provide recommendations on enabling two-factor authentication, using biometrics, and creating strong passwords to enhance wallet security.

c. Regular Updating and Backing Up the Wallet: Emphasize the importance of regularly updating mobile wallet software and securely backing up wallet information to avoid loss or unauthorized access.

d. Exercising Caution with Public Wi-Fi Networks: Educate users about the risks of using public Wi-Fi networks for crypto transactions and recommend using virtual private networks (VPNs) when accessing wallets on-the-go.

e. Educating Oneself About Common Scams and Frauds: Offer insights into various scams and fraudulent activities targeting mobile wallet users and provide tips on how to recognize and avoid falling victim to them.

V. Emerging Trends in Mobile Wallet Technology:

a. Multi-Currency Support: Discuss the growing trend of mobile wallets supporting multiple cryptocurrencies, providing users with broader choices and flexibility.

b. Integration with Decentralized Finance (DeFi) Platforms: Explore the integration of mobile wallets with DeFi platforms, enabling users to participate in decentralized lending, staking, and yield farming.

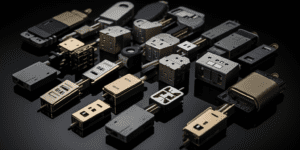

c. Hardware Wallet Compatibility: Highlight the compatibility of mobile wallets with hardware wallets, offering an additional layer of security and offline storage for users’ private keys.

d. User-Friendly Interfaces and Intuitive Designs: Discuss the importance of user-friendly interfaces and intuitive designs in enhancing the user experience and promoting broader adoption of mobile wallets.

VI. Expert Insights and Recommendations:

a. Interviews with Industry Experts and Cybersecurity Professionals: Provide expert opinions and insights on the current state of mobile wallets, potential risks, and recommended security practices to help users make informed decisions.

b. Tips for Minimizing Risks and Maximizing the Benefits of Mobile Wallets: Present expert recommendations on how users can effectively manage and secure their digital assets while utilizing the convenience of mobile wallets.

VII. The Future of Mobile Wallets:

a. Advancements in Security Measures: Discuss future advancements in mobile wallet security, including biometric enhancements, decentralized authentication, and secure enclave technologies.

b. Adoption and Acceptance by Merchants: Explore the potential for continued growth in mobile wallet adoption by merchants, enabling seamless cryptocurrency payments in various industries.

c. Regulatory Developments and Compliance Considerations: Highlight the potential impact of evolving regulatory frameworks and initiatives, emphasizing the importance of compliance and recognizing the role of regulation in enhancing trust and protection for mobile wallet users.

Conclusion:

Mobile wallets offer unparalleled convenience for managing cryptocurrencies on the go. However, it is crucial to understand the risks involved and implement best practices to mitigate them effectively. By staying informed, choosing reputable providers, and adhering to security protocols, users can enjoy the benefits of mobile wallets while safeguarding their digital assets, leading to a secure and convenient crypto management experience.